By Edward Chisanga and Caesar Cheelo

On 5th May 2020, The Economist published an article by Dambisa Moyo, our Zambian compatriot reading, “Marshall Plan for Africa”, which attracted some response from various observers and scholars. Because we notice that Dambisa repeats in this article what she has said before, in her book, “Dead Aid,” namely, eulogizing trade between Africa and China with generalizations rather than detail, we wish to react to one particular point and raise some debate around this. In a glorifying way, Dambisa’s article highlights that Chinese exports of goods to Africa reached US$90 billion in 2018. It is a useful headliner insight. In her book, she also happily advises Africa to trade with China and, again quotes some trade figure between the two without providing detail.

Our concern is that without detail behind the statistics, the headliner is prone to be misconstrued. We therefore try to interrogate some of the commonly held arguments around China-Africa trade relation. We draw on UNCTADstat (https://unctadstat.unctad.org/) trade statistics to build Table 1 and Figure 1 below, which form the basis of most of our ensuing comments. Table 1 provides estimated exports of $104.5 billion (not far from Dambisa’s figure and acceptably so) as China’s total exports of all products or goods to Africa in 2018. By no means pillorying Dambisa, the approach of presenting trade statistics without providing details has at least one key weakness. It leaves considerable room for speculation and omission of important information. Simply stating that China’s exports to Africa reached US$90 billion is rather general and could paint an overly China-centric picture. A balanced approach with detail would be more helpful.

The summit and quality of trade is manufacturing

It is a good starting point to highlight China’s aggregate trade with Africa and vice versa. But, in in order to understand the quality of that trade, it is important to dissect or disaggregate the trade and understand its ins and outs. The China-Africa trade relationship in general epitomises glaring and unbridled lopsided partnership in favour of China and at the expense Africa. This can be observed in Table 1 and Figure 1, which, even in aggregate terms, shows imbalances of China’s total exports to Africa of all products of $104.5 billion, reflecting about twofold that of Africa to China. On the other hand, despite lower absolute values, Africa exported more all products to the US than the US did to Africa.

However, our main chronicle or narrative is about drilling down to the China-Africa partnership in terms of trade in manufactured goods; which we refer to as the “summit of trade”. In Table 1 and Figure 1, it is evident that almost everything that Africa exports to China is primary commodities or unprocessed goods which accounted for 96% of its total exports. As can be seen, instead of reducing this dependence, Africa’s share rose from 66% in 1995 and this continues unabated. Meanwhile, China’s exports to Africa are largely manufactured goods, accounting for 94% in total, a rise from 88% in 1995. So, Africa’s dependence on imports of manufactured goods from this partner is rising instead of going down. Experts like Dambisa and the authors have a responsibility to highlight asymmetries like the one seen in China-Africa trade partnership to help our leaders enrich their dialogue with the latter for purposes of creating balanced trade partnership.

Notable too is the fact that the proportion of Africa’s exports of manufactured goods in total to China eroded from 19% in 1995 to 4%, so, even the little that is being exported as manufactured goods to China is divesting. We also included Zambia’s share of exports of primary commodities to China in total and found that they account for 98% meaning almost no manufactured goods are exported to that country. The flip side is that the proportion of China’s exports of manufactured goods in total to Zambia is 94%, meaning almost everything coming from that country is manufactured goods. Yes, infrastructure in roads comes from China but it would be appropriate to rethink and encourage the policy of a partnership that that focuses on teaching Zambian firms, students and other related institutions as well as doing exchange programs between the two countries in production, skills development and show-casing how manufacturing, starting with textiles and clothing is done in China juxtaposed by foreign direct investment and technology transfer.

That is why, if we might be indulged, we would advocate for encouraging African countries to expand exports in manufactured goods with the United States (US). Although Africa’s actual export values of all products to the US are smaller than those to China, the share of Africa’s exports of manufactured goods in total to the US rose from 15% in 1995 to 23% in 2018 while that for primary commodities fell (Table below). The US’s Africa Growth and Opportunities Act (AGOA) provides free market access for Africa’s exports particularly of textiles and clothing products to the US and this has largely contributed to more exports of manufactured goods. The paradox is that Africa is withdrawing. In 2008 and 2018 while Africa’s exports of manufactured goods to the US remained the same, $7.7 and $7.2 billion respectively primary commodities slumped from $100.4 to $23.2 billion due largely to market diversification to China (not in Table 1). Yet, this market diversification is not having a corresponding diversification or value addition in exports.

Therefore, considering the difficulty of breaking old trade habits, if the traditional pattern of exporting primary commodities to China cannot be changed, Africa must strive to preserve, and in fact expand exports of manufactured goods to the US. Equally, we would argue that instead of a Marshall Plan for America and Europe that provides direct cash transfers to households, an “Investment Master Plan” that focuses on expanding foreign direct investment with impact in productive sectors like manufacturing and technology transfer to Africa should be erected. This should build productive capacity and in turn boost the manufacturing sector, thus expanding Africa’s exports of manufactured goods to the US and other rich countries. That would be a better development model than the ones we have witnessed before, which simply help local populations to cope with their poverty situation from day to day (delete because it repeats blue below). In part, because the structure and behaviour of bilateral recipients of donor funding remains the same, a Marshall Plan is unlikely to yield anything different compared to what previous flows of aid delivered.

Remember too, Vietnam, a small country in Asia has overtaken Africa in exports of manufactured goods worldwide. In 1995, Africa’s global manufactured exports to the world stood at US$28 billion whereas Vietnam’s were US$2 billion. In stark contrast, in 2018, African manufactured exports had increased to US$112 billion while those of Vietnam had risen to US$197 billion. Africa’s performance in international economic diplomacy has become so low that it is no longer necessary to compare its performance with Asia as a region because all you do is compare with Vietnam. It is such information that Dambisa and others, the authors of this article included, ought to be critically analysing and sharing with African Governments to help them focus on industrialization and trade strategies that matter. Manufacturing value added matters for international trade, not big export numbers based on raw minerals and petroleum oils. The configuration of China’s trade with Africa and vice versa ought to change and promote the latter’s integration in global trade rather than perpetuate marginalization. That is good for China. That is good for Africa.

Table 1: China’s and Africa’s exports of all goods to each other in (US$ million)

| 1995 | 2018 | ||

| China to Africa | Total all products in $millions | 1,822 | 104,537 |

| Primary commodities share in total in % | 10 | 6 | |

| Manufactured goods share in total in % | 88 | 94 | |

| Africa to China | Total all products in $millions | 1,420 | 54,360 |

| Primary commodities share in total in % | 66 | 96 | |

| Manufactured goods share in total in % | 19 | 4 | |

| US to Africa | Total all products in $millions | 7,086 | 26,043 |

| Primary commodities share in total in % | 43 | 36 | |

| Manufactured goods share in total in % | 55 | 49 | |

| Africa to US | Total all products in $millions | 16,498 | 31,285 |

| Primary commodities share in total in % | 81 | 74 | |

| Manufactured goods share in total in % | 15 | 23 | |

| Zambia to China | Primary commodities share in total in % | 99 | 98 |

| China to Zambia | Manufactured goods share in total in % | 100 | 94 |

Source: Unctadstat (https://unctadstat.unctad.org/)

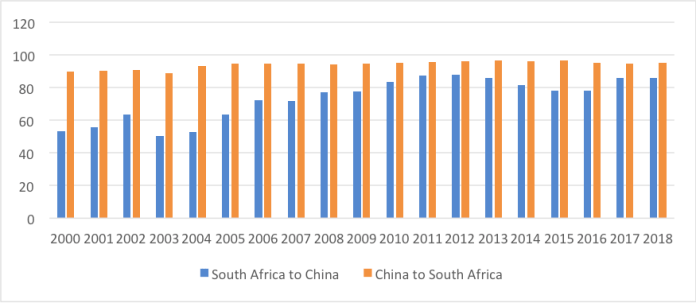

It is disquieting that not even South Africa – a BRICS country like China – exports significant volumes of manufactured goods to China. Figure 1 below shows trends in South Africa’s proportion of exports of primary commodities to China in total. From 2000-2018, the share rose sharply from 54% to 86%. On the other hand, the share of China’s exports of manufactured goods to its partner surged from 90 to 95%. Sadly, for South Africa, whereas in 2000 its share of exports of manufactured goods in total to China was a handsome 45%, by 2018 it experienced erosion to 14%. Some observers might disagree, but it is flabbergasting to learn that South Africa, Africa’s economic jewel, also behaves like the Continent’s rentier states that depend on exports of petroleum oils and mineral products. South Africa’s top exports to China are rather basic, comprising of ores and concentrates of base metals, iron ore and concentrates, pig iron, copper, wool and other animal hair, pulp and waste paper, fruits, jewellery and articles of precious material and silver.

Figure 1: Proportion of South Africa’s exports of primary commodities to China in total in %

Source: Unctadstat (https://unctadstat.unctad.org/)

Source: Unctadstat (https://unctadstat.unctad.org/)

Finally, taking detail into account equally shows that trade between Africa and China or China and Africa is embodied with further asymmetries. One of them is that the distribution of China’s total exports of all goods of $ 104.5 billion in 2018, from our Unctadstat source reveals that of the 55 African countries, 28 of them accounted for 95%, leaving the other 27 with only 5% or $5.0 billion in absolute values. In China’s exports of manufactured goods to Africa, 24 African countries accounted for 90% leaving 31 countries to account for only 10% or $9.0 billion. The other contrast is that Africa’s total exports of manufactured goods to China was only $2.3 billion in 2018, and, of this total 23 countries accounted for 99% leaving 32 countries with only 1% or $30.8 million. In Africa’s’ total exports of all goods to China of %54.4 billion in 2018, 16 countries accounted for 95% leaving the majority 39 with only 5% or $2.8 billion.

Summary

In closing, one can argue that the extolling of China’s exports to Africa must be looked at with caution. Preference of the current form of trade between China and Africa depends on what we want to praise: sheer large export numbers of primary commodities or quality of trade? We believe it is the quality of trade that has distinguished Asian countries from Africa. It is trade in manufactured goods that has contributed to reduced poverty and increasing prosperity in Asia. On the other hand, exports of primary commodities have failed to do the same for Africa. Building productive and export capacities in manufacturing is a developmental imperative for Africa. Analysis of this trade must also take into account the growing and huge unevenness in country distribution of benefits.

Some countries are deeply inside the circle while many too are in the peripheral. Africa’s past economic development difficulties have many similarities with China. The cultures are also closely related. China’s economic model, in particular in manufacturing may be easier to share with Africa for the benefit of the latter. But this can take place in negotiations, and, as experts, it is these negotiations that we must encourage Africa to get into and obtain favourable trade-off. If China is interested in petroleum oil or copper, there must be a better price to pay other than money. Money comes and quickly vanishes. But knowledge and skills, in manufacturing often have longer life spans. The modalities of obtaining this exchange is what Africa needs to sought out. Edward and Caesar would rather exchange Africa’s wealth with this kind of knowledge.

Western governments have found out that having employed citizens in subsidised sectors producing goods is better than having unemployed citizens and importing the same goods from China , making a profit…….

The social and tax benefits of that employment far outweighs any short term benefits of importing those goods cheaper than producing them locally

Let me guess, the author thinks the west’s exploitation of our resources during colonial servitude is a better option because it is better to be exploited by a musungu than any other race. These western funded analysts are in the same bracket as upnd and diasporan clowns

Let me ask just one question? What have you authors done to help mother Zambia instead of just fault finding?

China will soon own Zambia. Best example is your new Airport in Lusaka.

Very very informative article. This type of analysis for sure is beyond the comprehension of a PF carder. China itself cleverly insisted on technology transfer when it opened up its markets to the west. The west looked at the profits they would make and for sure made run away profits. The real benefit for China is there for everyone to see now. It was long term technology transfer not money which quickly evaporates. Our corrupt leaders in PF have hijacked our lives. HH would have taken Zambia to respectable levels by now. The PF years have been wasted years indeed. To imagine that they still want to continue in their mischief is beyond a normal person. I pit Zambia. Change will not come on silver platter because the devil is viciously using PF to turn Zambia into a failed state. Good…

Economics is good, it gives Economists Jobs. Nothing else.

People are not so easy to be fooled by those western funded analysts any more, rediculous.

@Kaizar I really like your comments but I have failed to follow your comment today. Are you saying the status quo is okay because it’s not a Muzungu it is another race exploiting Zambia. I thought we should stand not to be exploited by anyone. Not arabs, not jews, not Chinese. Shocking is an understatement to find a normal person content with his country being exploited.

I don’t know why people are seeing PF or UPND in this very informative article.

The authors have clearly done a great job explaining the status quo, and have argued that if we want real tangible change in our continent, the American model is better. Allowing manufacturing in the country adds value to what we export and creates jobs.